Non-owner Car Insurance- Can I Get Car Insurance Without A Car? Things To Know Before You Get This

vans car insurance affordable cheapest auto insurance

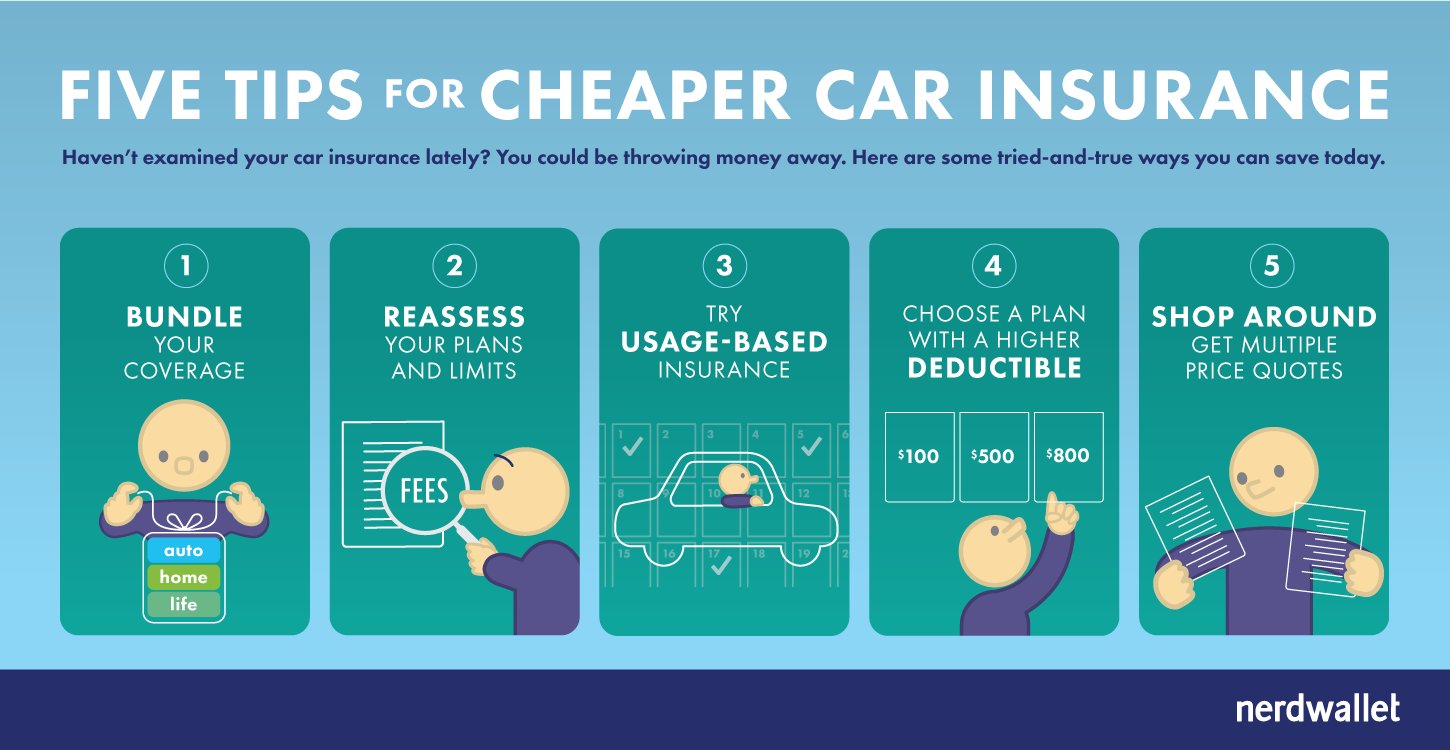

While there are a couple of methods to get auto insurance policy, the ideal and also most reliable way to obtain covered is by comparing quotes from multiple business online., you must begin by gathering the personal details you'll need, including the social safety and security numbers of all the drivers in your family, your chauffeur's certificate number, as well as details about your car.

Identify exactly how much vehicle insurance coverage you require, Figuring out just how much insurance coverage you require is one of the most fundamental parts of buying car insurance policy. Usually, it's a great suggestion for vehicle drivers to get as much responsibility insurance coverage as they can afford. Adding extensive as well as accident insurance coverage is a great suggestion, however the quantity of insurance you must get depends upon your automobile's value, too.

: Covers medical and also rehabilitation expenses if you or your guests are wounded in an automobile crash. risks.

As you go shopping for insurance, be sure to look thoroughly at whether there are any attachments you can remove. Contrast auto insurance policy quotes, It's an excellent idea to get quotes from a few different insurance coverage firms before you choose a plan.

3 Simple Techniques For Getting A Driver License: Mandatory Insurance - Dol.wa.gov

auto credit score vans cheaper

You ought to seek the insurer that uses you one of the most security and also the very best customer solution at the most affordable rates. affordable car insurance. Uncertain which company to go with? Use our contrast cars and truck insurance policy page or our listing of the finest vehicle insurance coverage business for more information regarding your options prior to you select a policy.

What are the various methods to go shopping for vehicle insurance policy? Depending on your choice, you might purchase a policy directly from an insurance coverage company, job with a representative, or obtain cars and truck insurance from a broker.

When you acquire a car insurance coverage plan, you'll set a begin date for when your policy will start, as well as you'll pay your first costs (insurance companies). You'll commonly obtain evidence of coverage as well as some kind of welcome bundle from your insurance firm, with details concerning exactly how to access your account and where to see your ID cards or affirmations web page.

Terminate your old car insurance plan, If you've been buying vehicle insurance coverage to change a present plan, wait up until after your new insurance coverage is in area before you terminate your old policy. You wish to see to it you don't leave any kind of voids in your coverage. To do this, set the termination day of your old policy as well as the efficient date of your new plan on the very same day (cheapest).

Auto Insurance - Car Insurance - Cincinnati Insurance Can Be Fun For Anyone

How do I get automobile insurance for the initial time? If this is your first time getting auto insurance, a professional can assist you identify your protection requires and also set a budget plan.

How do I restore my vehicle insurance coverage? Numerous automobile insurance coverage immediately restore at the end of the plan term. You'll be alerted by mail or e-mail if your policy is set to restore, and also you may be triggered to verify that your info is just the same before renewing your plan.

Can you get auto insurance immediately? Yes, you can get car insurance promptly with a lot of insurance business.

Automobile Policy Defense Vehicle policies commonly provide the following types of protection: Bodily Injury Liability: Pays, approximately the limits of the plan, for injuries to other individuals you trigger with your vehicle (car). Building Damage Liability: Pays, approximately the limitations of the policy, for damage to various other people's building triggered by your auto.

An Unbiased View of Florida Insurance Requirements

Crash: Subject to an insurance deductible. It will certainly spend for damages to your automobile triggered by collision or distress. Comprehensive: Spends for problems to your cars and truck triggered by hazards other then collision or trouble. This includes such losses as theft, fire, a windstorm and glass damage. A deductible may use. Various other: There are various other insurance coverage's such as towing and auto rental which might be readily available.

If the prices are reasonable, adequate, as well as not extreme or unfairly biased, the companies may utilize them. This allows competition to exist and allows Indiana people to purchase insurance coverage at a reasonable rate.

suvs cheap insurance car insured car

When contrasting expenses, make sure each company is quoting on the exact same basis. The least expensive policy is not constantly the very best plan - cheaper. Some score factors insurance provider might use are: Age and also Sex Marital Condition Motorist Record Vehicle Usage Area of Residence Plan Limits Deductibles Kind of Auto Motorist Educating Insurance Claims Background Credit Rating Cancellation or Non-Renewal Constraints Insurance provider have to comply with certain guidelines to terminate or non-renew an insurance coverage in Indiana.

When you drive somebody else's auto, the owner's vehicle insurance coverage ought to cover you, assuming you're using the car with the owner's authorization. If you get right into an accident as well as the problems surpass the quantity specified by the proprietor's responsibility insurance coverage, you might be on the hook for a considerable quantity of money - cheap.

The 6-Minute Rule for Free Car Insurance Quote - Save On Auto Insurance - State ...

cheapest car accident cheaper auto insurance vehicle insurance

Non-owner insurance coverage secures you by boosting the amount of your complete insurance coverage. Non-owner insurance policy can also be valuable if you will certainly be without a cars and truck for a duration claim, for investing a year abroad as well as wish to keep continuous insurance policy protection to avoid higher prices in the future. This is useful because insurance companies commonly bill higher prices if your insurance policy coverage has lapsed recently (auto insurance).

You may see a boost in prices by approximately around 14% a year if there is a gap in insurance coverage for up to thirty day. A non-owner insurance plan is a sort of responsibility protection that offers you with bodily injury and also residential or commercial property damages obligation protection What is non-owner insurance coverage? When you're driving a vehicle that somebody else owns and also causes an accident, it will spend for injuries and also damages to others and their residential or commercial property.

Some insurance policy business won't also take customers who can not reveal six months of prior coverage, forcing drivers to shop from high-risk suppliers for as much as double the cost. That claimed, some states don't permit insurance companies to bill more if a lapse was due to abroad army solution, a hospital stay or unemployment.

What does non-owner insurance coverage cover? A non-owner insurance policy mostly covers: Some vehicle insurer also supply: Your non-owner automobile insurance policy might likewise cover you when you lease a vehicle as well as enter a crash. Not all non-owner plans prolong insurance coverage to rental autos, so inspect the policy's fine print prior to acquiring your plan - perks.

About Car Insurance - Get An Auto Insurance Quote - Mapfre ...

If it's not adequate to cover damages, your non-owner plan would certainly then pay out as second protection given your plan's liability limitation is high sufficient. For the non-owner policy to start as additional protection, its obligation limitation needs to be greater than the automobile proprietor's obligation limitation. If the automobile owner's responsibility restriction is $10,000 for residential or commercial property damage, and you trigger $17,000 in property damages in a mishap, your non-owner insurance would cover the last $7,000 given your obligation limit goes to the very least $17,000 - insured car.

Just how much does non-owner insurance coverage price? A non-owners policy costs significantly much less than a common insurance plan because non-owner vehicle drivers normally drive much less than motorists who have their lorry, decreasing the chances they'll be in an accident - car insurance. There are substantial price distinctions depending on the state. Right here are one of the most pricey as well as the very least expensive state standards for non-owner auto insurance policy: The price of non-owners insurance policy is $386 a year, based on Insure.

Nevertheless, cost differs relying on the state and South Dakota is the least costly state for non-owners insurance coverage with an average rate of $174. vehicle. Most pricey states for non-owner auto insurance: Least expensive states for non-owner cars and truck insurance coverage: The costs of a non-owner policy likewise vary by community. Here are the ordinary distinctions in.

accident insure laws car insurance

If someone in your residence has a lorry, you will need to be provided as a chauffeur on that vehicle insurance coverage policy. Just like a traditional policy, it's important to contrast vehicle insurance prices estimate prior to getting a non-owner insurance coverage policy. You need to contrast non-owners automobile insurance policy quotes from at the very least 3 service providers to see that has the most affordable price for the protection you desire. vehicle insurance.

Auto Insurance - State Of Michigan Fundamentals Explained

Nonetheless, if you share a home with someone that has a cars and truck that you borrow, you may need to be noted as a vehicle driver on the automobile proprietor's plan. The insurance company may not cover a mishap you cause while driving a vehicle you obtained from someone living in the very same home - insurance.

You can get driver's insurance without an automobile (insurance company). If you have a permit, do not possess an automobile but consistently drive an automobile that comes from a person else, you need non-owners insurance. Also, if you frequently rent out autos, you may wish to consider purchasing non-owners insurance coverage to increase the quantity of protection you have.

It is not legally required if the lorry proprietor is insured. But you might wish to consider purchasing non-owner insurance coverage if you drive another person's automobile regularly. Related Articles.

https://www.youtube.com/embed/HQivIqd0QWE

Non-owner policy is auto insurance for non-vehicle owners. This kind of policy covers you if you remain in a crash while driving a person else's vehicle. You should think about getting non-owner vehicle insurance coverage if you obtain or rent cars on a regular basis or if you do not have an automobile but need an SR-22 type.